Baby Steps by Dave Ramsey (but for “Make-Up Assignments” instead of “Credit Card Debt”)

“Sean, we’re in something of a crisis. So many missing assignments. Everything just keeps piling up. Also - he doesn’t know how to study! He just says ''it’s not that hard,’ and doesn’t prep. What do we do?”

Very common client story.

They have a steady stream of 1.5 hours of homework per night, and also … something like 10-50 hours of make-up assignments.

We liken this to a family who has ongoing bills to pay and some credit card debt. How do you keep it all straight? Consider Dave Ramsey for a second.

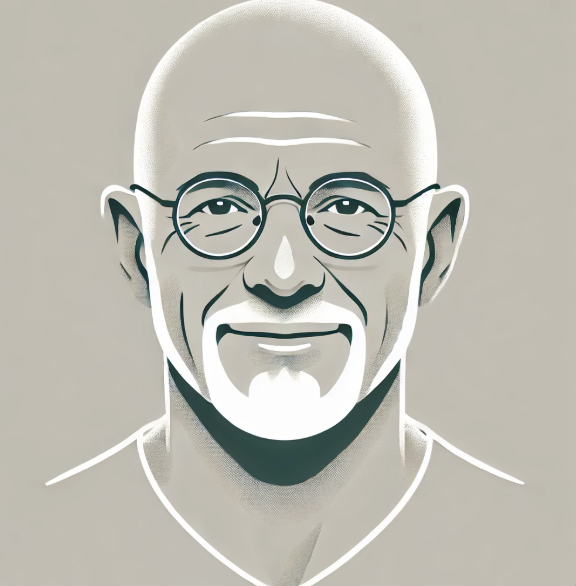

Dave is the one of the funniest and charismatic radio hosts alive. He also has developed a super simple plan for getting out of debt, the so-called “baby steps.” It’s not perfect, but it’s helped millions get their finances better organized.

I ran my Dave Ramsey emulator and tried to apply it to the kid who has 20 hours of make-up work.

What would Dave do?

Moms come to us and want something like better habits, less screen time, better hygiene, more sleep, less Manga, more friends (but the right kind of friends), better grades, a less strained dynamic at home, more independence, and a '“system” for doing their work.

That’s a lot!

So we need to prioritize, Dave-style. We love sleep as a foundation, but some families, and most kids, want academics first. So we say - let’s focus on academics, and only academics.

Applying Dave’s baby steps to make-up work:

Step 1: List All Your "Debts" Clearly

Just like Ramsey advises listing out debts smallest to largest, we begin by clearly listing every missing assignment from every class. It might look something like this -

(… and if that looks intimidating, don’t worry, we can help!)

Step 2: Create an Academic "Snowball"

Once listed, pick the smallest or easiest assignments first - not necessarily the most important or the highest-value ones. This might mean knocking out a 5 minute Spanish assignment before a make-up test in Physics (that you originally earned a 20% on), even though latter has higher ROI.

This approach creates quick wins, providing immediate psychological rewards. Dave says:

“Once that smallest debt is toast, roll what you were paying into the next smallest, creating a snowball effect. It’s not about math. It’s about momentum and gaining quick wins. Before you know it, you’re knocking out debts left and right, building confidence and momentum like a snowball rolling downhill.”

Step 3: Stay on Top of Current Assignments

Even as you're clearing makeup work, you have to "pay your current bills."

Create a daily homework budget - a consistent block of distraction-free time dedicated solely to current homework.

Step 4: Build Your Academic "Emergency Fund"

Ramsey suggests creating a financial safety net. I wondered - what’s the “emergency fund” for our clients? I think it’s the weekly "maintenance session" (e.g., Sunday evening) to preview the upcoming week - review assignments, make plans for when you will complete them.

This session, ideally done with a parent or coach, helps catch small issues before they spiral into another crisis.

Step 5: Invest in Long-Term Savings

Finally, develop a habit of making small, regular time "deposits" into longer-term assignments - could be college applications, research papers, or AP exams. Even 20 minutes a few times a week creates compounding results.

***

Just like with finances, your academic debt won't disappear overnight! It will take time, but you now have a plan.